Reflections on the Horizons

What a crazy time it has been!

I hope we are all doing well during the mostly down or sideways markets. What is the catalyst to kick this cycle back into gear?

Let's reflect on dHEDGE Horizons product release from mid December:

The Horizons release consists of 4 major parts:

- Toros Finance, a new tokenized derivatives protocol, launching on Polygon

- dHEDGE launching on Optimism with a $100k Trading Competition

- Triple Performance Mining Rewards, and

- DHT Dynamic Bonds

Toros Finance

An incubated protocol from the dHEDGE ecosystem, enables a suite of on-chain tokenized derivative products.

Current leveraged tokens:

- ETHBULL & BTCBULL, and

- ETHBEAR & BTCBEAR.

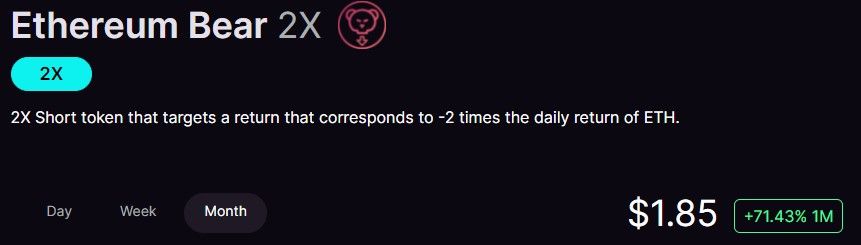

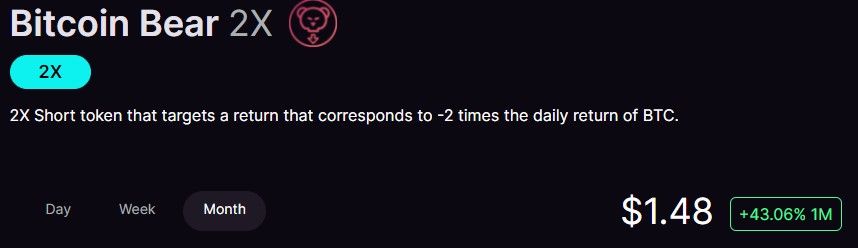

Given the current market it is not surprising to see the leveraged short tokens have performed very well over the past month.

ETHBEAR = +71%!

BTCBEAR = +43%!

Toros tokens will soon be enabled for dHEDGE Managers, I can’t wait to see these used to full potential to create higher returns even in a down market.

dHEDGE on Optimism

Optimistic Ethereum is a L2 scaling solution. dHEDGE is now deployed on Optimism and integrated with Synthetix/Kwenta for trading the current suite of available synths.

In just one month 45 new pools opened with over $435k AUM and counting.

Trading Competition with Synthetix

Synthetix and dHEDGE co-sponsored a trading competition on Optimism with a prize pool of $100k. We had great engagement on twitter with the daily $1k lottery.

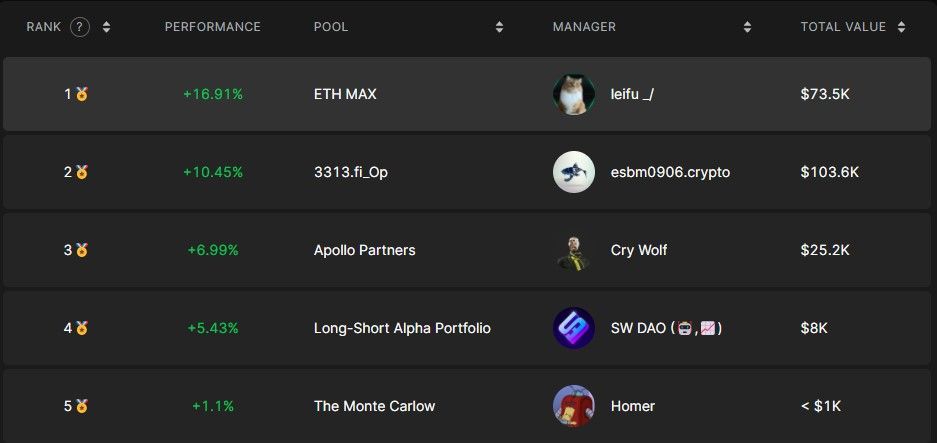

The competition was very close, only 15% separating the top 5 pools.

The top 5 were:

It is interesting comparing the performance to the general market:

ETH over the last 30 days: -25.7%

BTC over the last 30 days: -13.6%

So in comparison the Managers did very well!

leifu _/ took full advantage of the sLINK rally in early January before hedging into cash during the market downturn.

Esbm0906.crypto used a similar strategy with sLINK but hedged into cash much earlier.

Cry Wolf rode sLINK for the first half of competition then diversified into sBTC and sETH.

SW DAO and Homer utilized frequent trading in all 3 assets: sLINK, sBTC and sETH .

Investors from the top 5 pools will share the $70k prize pool made up from $50k DHT and $20k SNX. Congratulations to all the winners and participants.

Triple Performance Mining Rewards

Polygon and 1INCH are co-sponsoring Performance mining for 3 months. This adds an extra $110k of value!

- $60k in MATIC and

- $50k in 1INCH

The first payout of the triple rewards has been completed. Pools on Polygon that earned DHT performance mining also received MATIC and 1INCH. These were airdropped directly into users wallets.

How performance mining works

DHT Dynamic Bonds

Over $70k has been raised so far in bond sales. This is currently being used to provide liquidity in a Balancer pool with dUSD and DHT. This will earn trading fees while dUSD is farming stablecoins and continuing to appreciate in value.

These bonds are a way for dHEDGE to grow the Protocol Treasury by selling discounted DHT that vest over a dynamic period of time. Most bonds so far have been vested for 12 months.

Keep an eye out for Toros Finance available for dHEDGE Managers, great opportunities to maximize returns and catch alpha.

Coming soon: dHEDGE Aurora.

The next product release in our natural phenomena codenames.

More About dHEDGE

dHEDGE is a decentralized asset management protocol connecting the world’s best investment managers with investors on the blockchain in a permission less, non-custodial, trustless fashion. dHEDGE aims to democratize the investing experience leveraging Blockchain technology.

Supported by some of the biggest names in crypto, including Framework Ventures, Three Arrows Capital, BlockTower Capital, DACM, Maple Leaf Capital, Cluster Capital, Lemniscap, LD Capital, IOSG Ventures, NGC Ventures, Bitscale Capital, Divergence Ventures, Genblock Capital, Trusted Volumes, Altonomy, Continue Capital, The LAO, bitfwd (比特未来) and Loi Luu, Co-Founder and CEO of Kyber Network,

Join the dHEDGE community on Discord, Twitter, Telegram English language, Telegram Chinese language and on WeChat.