Manager Profile - Pendulum Flow

We catch up with Pendulum Flow, the manager currently leading the dHEDGE leaderboard, and learn about his Pendulum Flow methodology.

Over the last 7 weeks, dHEDGE users have watched on as a new manager opened two pools and grew each of them from 0 to over $100k in TVL.

Pendulum Flow Degen Leverage is up 80% since September 15 2022, with 79 unique investors, whilst the more conservative (non leverage) Pendulum Flow pool is up 38% in the same period.

At time of publication Pendulum Flow held the #1 and #3 positions on the default dHEDGE Leaderboard, so we thought it was time to catch up and meet the trader behind these pools, and also learn more about his Pendulum Flow methodology.

Q. Who inspires you in your investment strategies?

[PENDULUM FLOW] I’m sick of the crypto gambling addiction that is so rampant. Most people lose money and those that 100x their account do so through luck, let’s be real.

Instead I like engineers. The calculated and unemotional. People who apply good science and maths to financial markets and generate predictable returns.

Pioneers like Ed Seykota. He ran his models on an IBM 360 the size of a room before qualitative analysis had even been invented. This thing was programmed with punch cards. Can you imagine!?

From 1970 to 1988 he was up 250,000%, averaging several hundred percent per year in the early days. Obviously returns declined as his account ballooned but he may have had the best trading run of all time.

I'm also a big fan of James Simons who co-authored Chern-Simons theory in 1974. This theory is now used by mathematicians to distinguish between distortions of ordinary space.

From 1990 to 2007 he returned 40,000%. His Medallion fund is now only open to employees, family and friends. He says that creativity is about discovering something new and you don’t do that by reading books or looking in the library.

Thanks to these pioneers, we can stand on the shoulders of the giants that came before us. While they don’t share their secrets, many share their philosophies and paradigms. And like Roger Bannister breaking the 4 minute mile, they have proven that ‘unnatural returns’ are indeed possible.

The difference between a good artist and a bad one, like the difference between a good mathematician and a bad one, is the ability to select the good combinations of colours or good combinations of numbers from the infinite possible combinations. This has to be done to avoid wasting time and the decisions must be made on the basis of quality. Quality is an attribute that can’t be defined and identifying it can’t be taught. Robert M Pirsig suggested quality is the point at which art and science intersect.

It is worth noting that both Ed Seykota and James Simons made their biggest returns by using pioneering techniques on immature markets (Ed Seykota looks pretty washed up these days TBH although James Simons is worth ~28B). Today, we have the same fertile grounds in Crypto. And like the pioneers who headed west into the new world, we risk arrows in our backs exploring this new frontier. But once the industry is worth 10s of Trillions, the unnatural profits will be gone. What a time to be alive; now is the time to capitalise on this fleeting period in history.

Q. What is the driver / what drives you in your investing strategies?

As a kid I was the poster child of white privilege, but the only thing I wanted was to play monopoly with my family all day. Mum and dad worked constantly though and rarely had time for us. My primary drive is to be there for my family AND provide for them like my parents did.

With the imminent arrival of my twin daughters recently I had ‘full-time-dad-status’ in my cross hairs. But the $LUNA crash pulled the rug on that dream. Thankfully, I only lost about a year’s worth of profits, so it could have been a lot worse. GMI money was suddenly a lot further away though and necessity is the mother of invention. How was I going to get unnatural returns in a bear market? This is how Pendulum Flow was conceived.

I also simply LOVE numbers. I run models on data sets in my spare time for fun and particularly enjoy investigating demographic trends (anything that can reveal investable insights).

Modelling data feels like treasure hunting for me. You know there are profits hiding in the numbers, unimaginable wealth if you can crack the code. Through a combination of art, science and grit, you can seduce the data to divulge its secrets.

Q. What is your risk management strategy?

No one should invest more in any crypto strategy than they can afford to lose. Everything in this industry is extremely risky. There is no guarantee that even Bitcoin isn’t going to zero. You could lose it all through an exploit, government regulation or any number of other factors that are beyond your control.

Assuming none of these things happen, it should be noted that Pendulum Flow attempts to reduce delta by correctly choosing the long term directional movements of the broad crypto market (specifically $ETH). When the model is wrong, there is full delta exposure with no hedge. We are simply dealing with probabilities here, the system is not infallible and there will be losing trades.

There are periods when the algorithm moves to cash if the market internals are indecisive. It also uses a dynamic EOD (End Of Day) stop and will reduce exposure at evolving profit levels. The specifics are programmed and change with the market conditions.

Pendulum Flow is currently trading $ETH and in the future may move towards a basket of crypto weighted by market cap (rather like an ETF). By sticking with large established cryptos, this limits the likelihood of the holdings making radical, sudden moves.

Let me say it again though; Crypto is risky, sudden moves of 30% or more could easily occur. Pendulum Flow is experimental, the Degen Leverage fund is… well… degen. Do not invest anything you can’t afford to lose. None of this is financial advice, buyer beware.

Q. Can you tell us about your algorithm? How did you develop it? How much work have you put into backtesting?

I have been building algorithmic trading models in traditional finance for almost 20 years. The hardest thing when it comes to trading models is filtering out the noise from the data.

The advent of ETFs was the big breakthrough for a retail quant like me. By providing liquid and affordable access to a basket of stocks, this dampened the unpredictable moves of the individual stocks in each fund. Then by measuring breadth data to combine volume and price action, I was able to build models based on momentum and capital flows.

I embarked on large scale tests across the major indices from 16 global markets to identify the technical measures that worked in various market conditions.

The same human driven cycles that we see in the stock market, repeat in Crypto. So I was able to transfer a lot of what I already knew worked in traditional finance to digital assets. However, due to the rampant manipulation of the crypto market the noise in the data was prohibitive to my style of algorithm and I wasn’t making any progress.

The breakthrough came by studying the internal movement of capital within the crypto market. This is visible thanks to the transparency of the blockchain and a measure called TVL (Total Value Locked).

For example; when there are more sellers than buyers of an asset, the price will fall. A price or volume based trading model would see this as a bearish data point. But if that capital is sidelined into a fiat-backed stablecoin, then it still remains as dry powder to BTFD (Buy The Dip). Such a situation is obviously less bearish than the price action alone would suggest.

If, on the other hand, those stablecoins get redeemed for cash IRL (In Real Life), that would be extremely bearish as the money has truly left the crypto market entirely.

Pendulum flow is able to take all this into account which has the effect of dampening the noise in the data. Through testing I also found TVL to be a powerful leading indicator of price action.

The game changer in all of this was when DefiLlama built the ability to exclude double counting from TVL. The Llamas truly are world class and I don’t think many people appreciate how astonishingly complex maintaining this feature must be. Prior to their innovation, TVL data was basically worthless because the same capital was counted several times.

This flaw in the way TVL was calculated, allowed Solana’s TVL to balloon to 10.5 Billion despite 7.5 Billion of it being completely fake. The numbers were deliberately manipulated by a single developer who looped the same dollars several times through protocols he controlled like Sunny Aggregator (which was potentially the most obvious Ponzi of all time).

I also found that non-fiat stable coins are worthless as a measure of TVL. They are pure pumpanomics so are excluded from my measure of TVL.

Additionally, TVL reflects capital that is deposited into DeFi apps and liquidity pools. People don’t enter a liquidity pool unless they intend to hold that position for an extended period. Otherwise they risk impermanent loss before the position has accumulated enough yield. So TVL is also a measure of the confidence or stickiness of capital.

I found that it mattered little, what protocol or chain was holding the TVL. The most important measure was aggregate TVL across the entire crypto market. This may change as the market matures and Pendulum Flow will evolve accordingly.

When building a trading model there are typically several variables that need to be set and refined through testing on historical data and simulations.

So far Pendulum Flow has been run across 173,000 years of simulated data (63,214,222 days to be exact). And orders of magnitude more, when you take into account for the knowledge transferred from my tests in traditional finance.

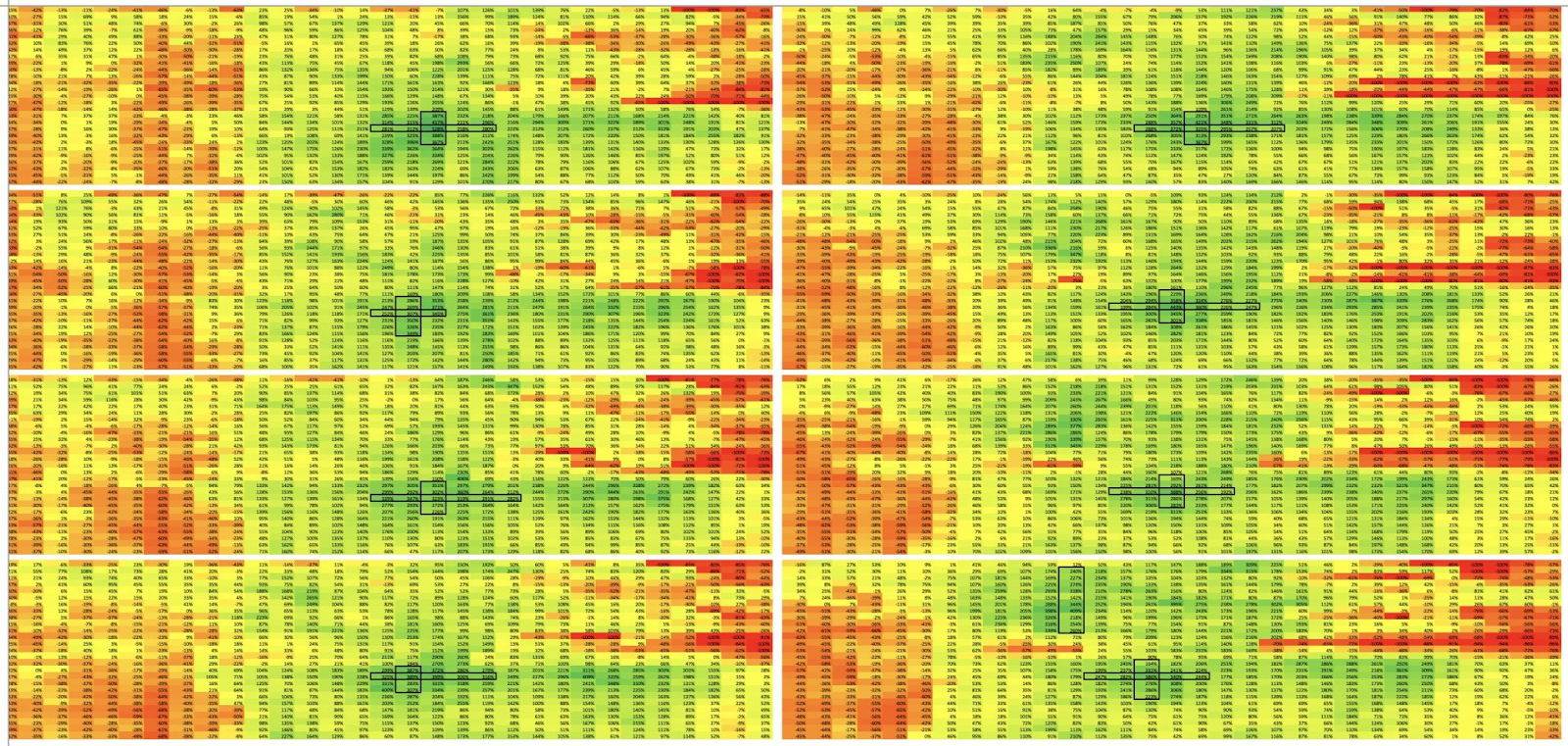

Pendulum Flow has 5 main dimensions to assess the inputs. The heat maps below show how the CAGR (Compound Annual Growth Rate) changes as the various settings are adjusted. Large sections of green and yellow = good.

A robust trading model performs well in all market conditions and through a wide variance of settings. This is important so you can avoid curve fitting or building a model that only works on historical data. Like a race car that only wins on the straight when the track is dry.

Instead, imagine a race car so fast it can win a drag race or around a windy track, regardless of the pit crew, driver, track conditions or tires.

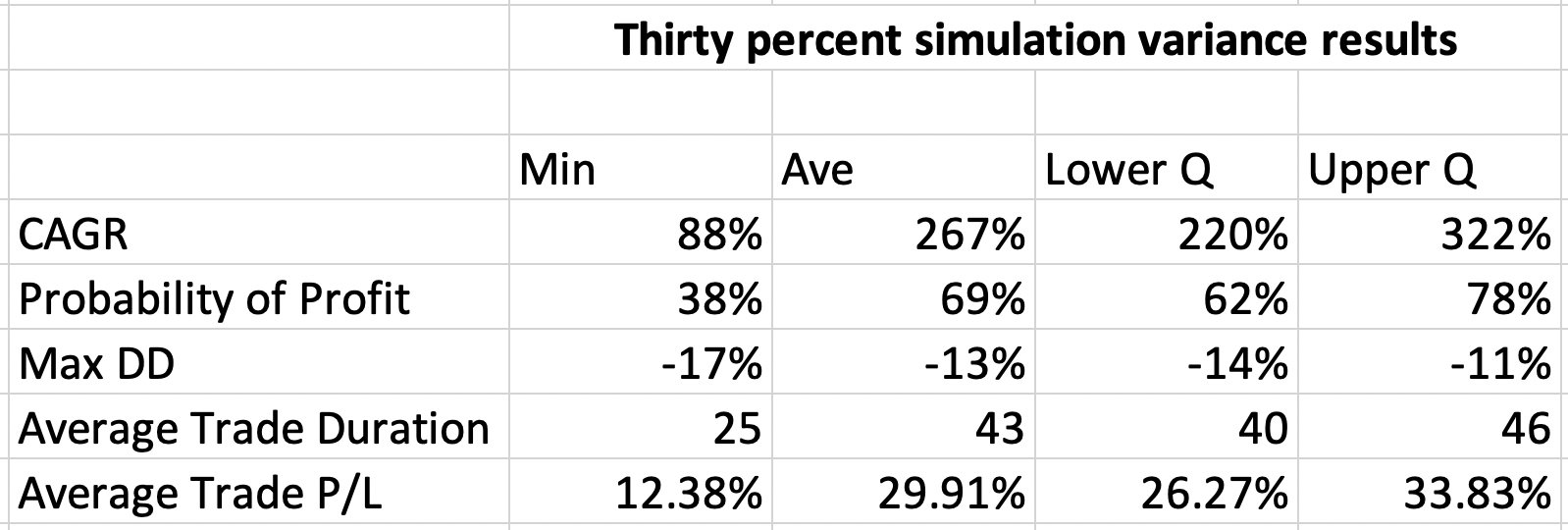

Below you can see the performance of Pendulum Flow pushing a 30% variance from the optimal settings. Basically showing what happens if you deliberately change the settings to be a long way off what you know is optimal.

The worst performing outcome was profitable on 4/10 trades with an average return per trade of 12.38% and a CAGR of 88%. The non-leverage Pendulum Flow fund $TVLP on dHEDGE is currently on track for a 930% CAGR. Frankly, I would be extremely happy with 88% per year.

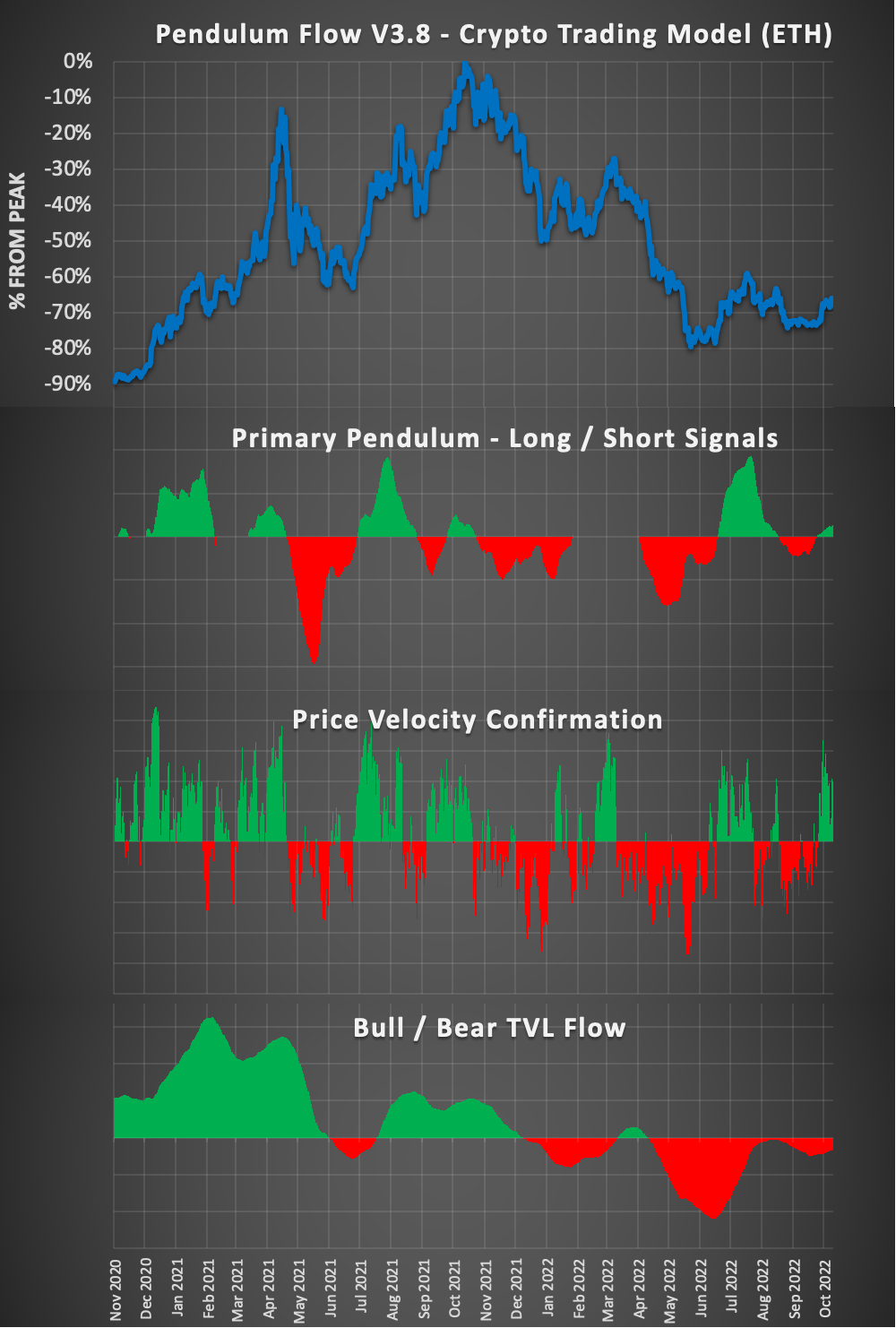

A visualisation of the trading signal inputs are provided below. The ‘Primary Pendulum’ decides if the model goes long or short and this is driven by TVL. Any signals must be confirmed by ‘Price Velocity’. If the signal is not confirmed then the model moves to cash until a new signal is generated. This typically reflects times when the market internals are indecisive.

I have considered putting the cash into an LP for yield but am not convinced that the couple of extra percent is worth the additional smart contract risk.

The ‘Bull / Bear TVL Flow’ shows the predominant trend as either Bullish or Bearish. Pendulum Flow can go Long in a Bear Market or Long in a Bull Market and vice versa.

The current signal is Long in a Bear Market.

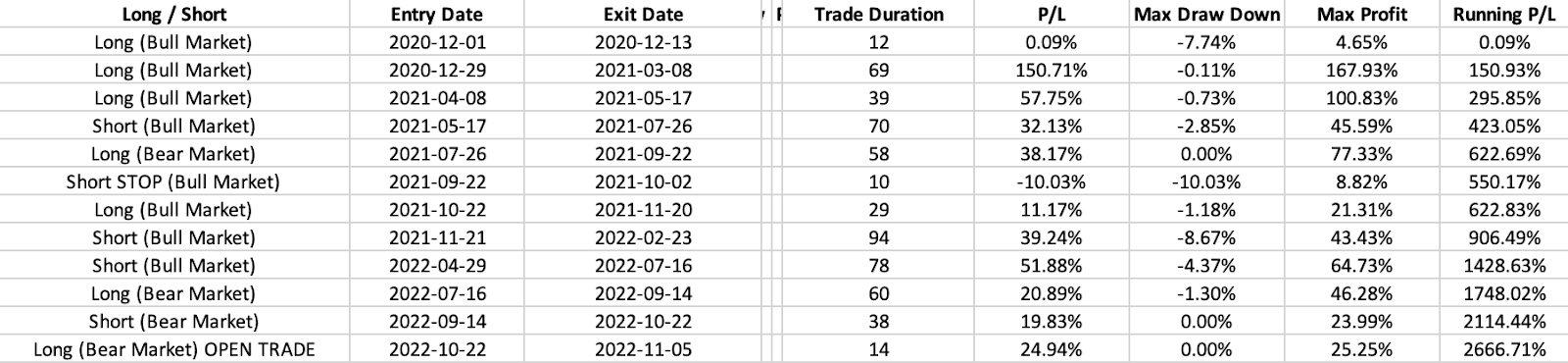

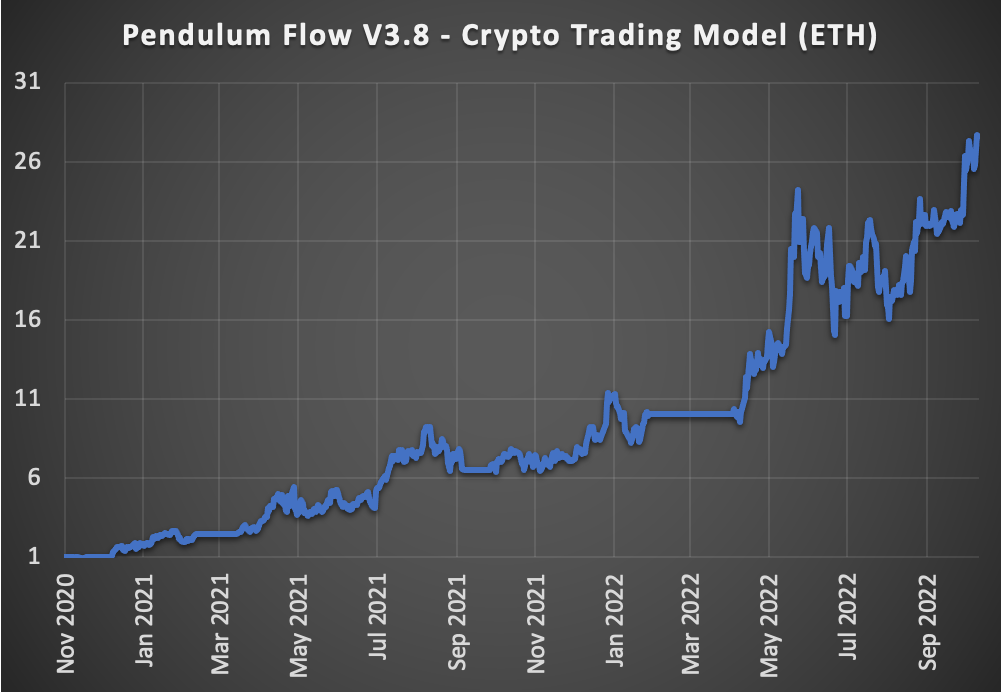

Below is a look at the specifics from the simulated historical trades for Pendulum Flow V3.8. The last two listed trades are recorded and verified on chain through dHEDGE.

Below is a chart of the returns on $1, had it placed all these trades over the last 2 years.

Below is a view of the first 51 days of live trades on dHEDGE for $TVLXP Pendulum Flow Degen Leverage.

Q. What are your short and long term goals with your pools?

I currently have just over 200K under management and my first really exciting milestone will be 100K in profits for investors. I’ll be disappointed if that hasn’t occurred within first 3-5 months.

By 15th Sept 2023 the funds will be 1 year old and my goal is to have 10M under management. I will probably restrict access to those on a white list once there is 2M under management. This will give me time to see if there is any friction entering and exiting positions with more significant capital.

Any OGs holding 1000 units or more will be added to the white list.

Q. Why should a potential investor invest with you?

They shouldn’t. None of this is investment advice and Pendulum Flow is not an investment grade product. Seek independent advice from a qualified professional who understands your personal situation and be prepared to lose any money you invest in crypto.

Q. What's your current market outlook? Thoughts on post-Merge ETH?

Thoughts post Merge:

IRL, standard of living = the amount of energy you can afford to waste to manipulate your environment. When your cost of energy goes up, your standard of living goes down. If one type of energy is too expensive then businesses and consumers will move to a cheaper source.

The base layers of crypto like $ETH are the energy of the metaverse. If the standard of living is to go up and businesses are to thrive, then capital will flow to the base layer with the best technology that can scale and scaling requires cheap transactions. So if crypto is to ever live up to the prophecy of consuming traditional finance, then fees must converge towards zero.

Each major advancement in human civilisation has come from a leap in the way to harness energy; making it cheaper and more abundant. The same will be true in Crypto.

Now imagine if it was more profitable to invest in energy than it was to actually use it. How well would the economy perform? Answer: It wouldn’t.

Therefore it is self-evident that in a thriving metaverse, capital must find the best returns from investing in the applications, not the base layer. So long-term I think that all layer 0/1/2s (including $ETH) will offer lacklustre investment returns.

Scenario 1 - Transaction fees stay high and crypto can't scale. The entire industry performs poorly, never evolving past being a casino for degenerate geeks.

Scenario 2 - Crypto scaling is made possible thanks to transaction fees converging towards zero leaving little value to be captured by the base layer. All L 0/1/2s perform poorly and 2-3 of them see 99.9% of the volume. Nearly all of the value is captured by the applications and chains like $ETH are purchased and consumed. Similar to the way we use electricity today, the base layers will be held with the expectation of utility, not investment returns.

On the way to scenario 1 or 2, I expect many spectacular pumps and just as many brutal dumps.

What is my current market outlook:

The market doesn’t care what I think. Pendulum Flow is currently 100% long $ETH. The model doesn’t have a bias or emotions and will follow the TVL.

The current signal is quite flaccid however. It wouldn’t take much weakness from here to turn short.

Q. Fun fact about you or about the world you’d like to share?

The average human has one breast and one testicle. Data can be true and also very misleading at the same time.

Q. How can other investors get in touch with you?

The best way is on twitter, my DMs are open https://twitter.com/PendulumFlow

You can also comment on any of my posts on dHEDGE where you will have a deeper level of anonymity.

To follow along with Pendulum Flow's performance on dHEDGE, links to his pools can be found below:

More About dHEDGE

dHEDGE is a decentralized asset management protocol connecting the world’s best investment managers with investors on the blockchain in a permissionless, non-custodial, trustless fashion. dHEDGE aims to democratize the investing experience leveraging Blockchain technology.

Supported by some of the biggest names in crypto, including Framework Ventures, BlockTower Capital, DACM, Maple Leaf Capital, Cluster Capital, Lemniscap, LD Capital, IOSG Ventures, NGC Ventures, Bitscale Capital, Divergence Ventures, Genblock Capital, Trusted Volumes, Altonomy, Continue Capital, The LAO, bitfwd (比特未来) and Loi Luu, Co-Founder and CEO of Kyber Network,

Join the dHEDGE community on Discord, Twitter, Telegram English language, Telegram Chinese language and on WeChat.