How to short WETH using AAVE and SushiSwap

Step 1:

Open your manager account, find the Manage Pool section, and select Aave.

Step 2:

Fund your Aave account with some Stablecoins, (the example already had 20 USDC deposited). Select Borrow Now.

Choose Wrapped ETH to borrow, select a risk factor, and select an interest rate type. In the example we can only choose from Variable APY, so this is selected. Click Continue.

Step 3:

Wait for the transaction to be confirmed. Click Dashboard to return to the dashboard, and you'll see the newly borrowed WETH in your account.

Step 4:

Next is to swap our new WETH for a Stablecoin. Given we're shorting because we forecast the price of $ETH to drop, we want to swap all our $ETH holdings to Stablecoins while we watch the price action.

Click on SushiSwap within the Manage Pool modal, select swap from WETH and swap to USDC. Select max for the WETH amount.

Hit SWAP.

Step 5:

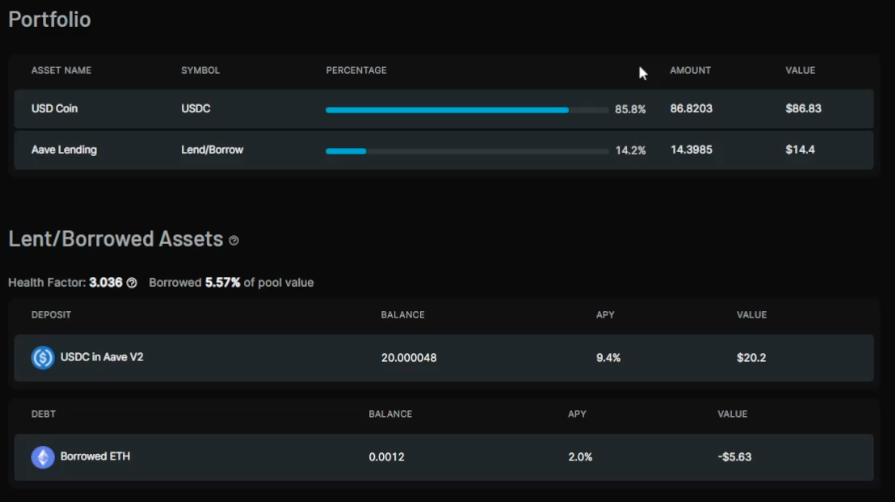

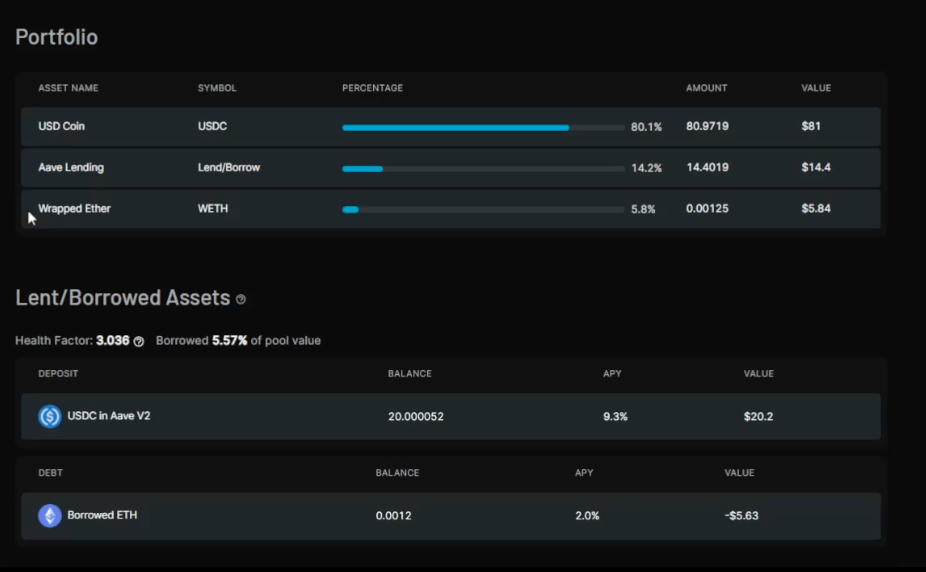

One that transaction is submitted, you'll see the Portfolio only holds USDC and a portion representing the lending in Aave. This Aave lending figure is the deposit collateral (USDC) minus the debt. The Portfolio no longer holds the borrowed ETH.

Step 6:

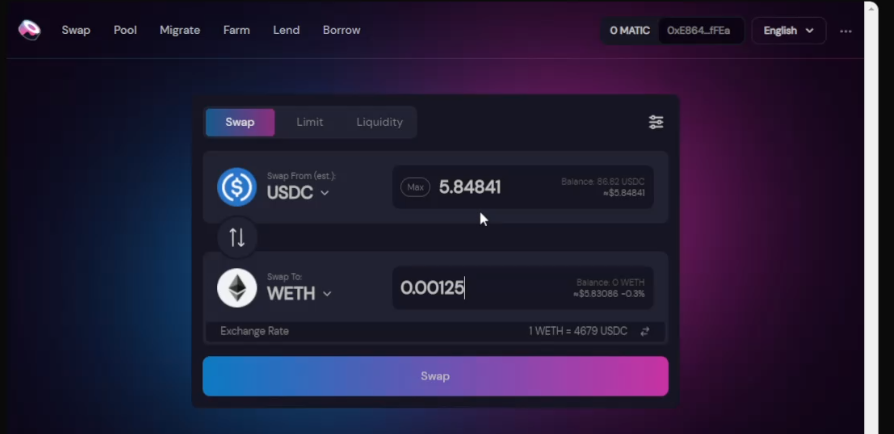

In the case where the price of WETH has dropped, we can go back into the portfolio and buy back the borrowed WETH at the reduced rate. Return to SushiSwap, buy at least the equivalent of borrowed WETH (in this example we'd borrowed 0.0012 WETH, so adding an extra rounding .00005 to ensure we have full coverage).

Click Swap.

At which point the new WETH will appear in your Portfolio:

Step 7:

Return to Aave, select Repay from the borrowed WETH section. Select max and continue. Then hit Repay.