DAO Treasury Management on dHEDGE

dHEDGE solves many of the typical DAO Treasury risk management issues via providing a fully transparent, trustless and non-custodial solution.

Intro

The new dHEDGE Aurora release integrates Uniswap v3 for dHEDGE v2 pools on Optimism and Polygon.

This new integration strongly positions dHEDGE as a formidable DAO Treasury Management solution, as the platform is purpose built to handle manager permissions, asset guardrails, address whitelisting and pool privacy features to limit eligible pool deposits.

In this post we go over a quick background to the challenges DAOs face in managing their treasuries, and move into the solutions dHEDGE provides to simplify this.

@ayyyeandy - DeFi Slate

Background

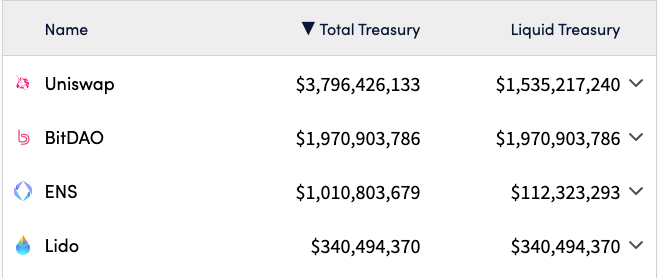

The rise of DAOs as structures to drive organisational growth has been spectacular over the last few years, especially within DeFi, with top DAOs possessing billions of dollars in treasury assets (openorgs.info, 25th Feb)

DAO Treasuries enable the sustainability of the organisation. They’re dipped into for operational costs and working capital, acquisitions, interactions with other DAOs e.g. token swaps, and especially important for income from trading activities.

Risk management of a DAO Treasury presents its own unique set of challenges. A well managed treasury should protect the DAO from underlying asset volatility, providing a stable and predictable asset base to plan future DAO operations.

A stable treasury should be closely and actively managed, which can be difficult when combined with typical risk management practices DAOs employ like multisig wallets and cumbersome governance processes.

Frequently we see DAOs try to circumvent cumbersome governance or administrative overheads by trusting individuals with huge sums of treasury, without community consultation. This often has damaging consequences as we saw recently with 0xSifu and Wonderland Money.

dHEDGE as a DAO Treasury Management Solution

dHEDGE solves many of the typical DAO Treasury risk management issues via providing a fully transparent, trustless and non-custodial solution.

Transparent via all trading activity being on-chain, auditable and verifiable.

Trustless via the suite of guardrails in place to help limit trading activity. Designated traders can be limited to transacting in specific assets, or via specific integrated protocols. Pool managers retain the ability at all times to delegate trader permissions or revoke access, without affecting the underlying pool assets.

Non-custodial in that designated traders never have ownership of Treasury funds. Assets positions are directed by traders but never at risk of being withdrawn or moved to external addresses.

The dHEDGE platform is also battle tested through being live since August 2020, audited twice by Certik (2021) and Iosiro (2020), and with a standing bug bounty program with ImmuneFi.

Pool Visibility

dHEDGE enables the ability to mark a pool as Private, removing it from leaderboards and any other public front end features.

This option can also be used together with the ability to whitelist specific deposit addresses, giving a manager full control over the flow of assets within the pool.

Trader Permissions

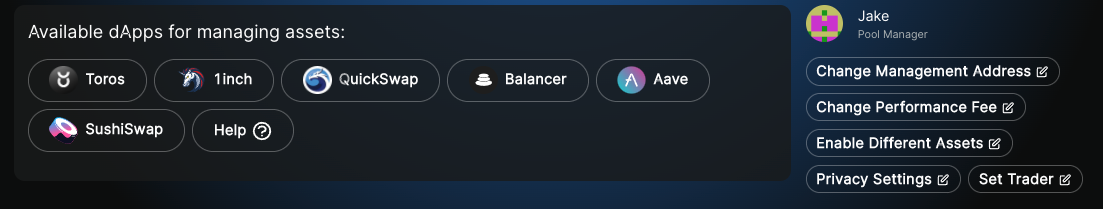

The Manager panel shows a range of options available to the highest level permissions. Features outlined below:

| Manager | Trader | |

|---|---|---|

| Change Management Address | ✅ | ❌ |

| Change Performance Fee | ✅ | ❌ |

| Make Pool Public/Private | ✅ | ❌ |

| Set a Trader | ✅ | ❌ |

| Enable Pool Assets | ✅ | ✅ / ❌ |

| Trade Pool Assets | ✅ | ✅ |

Example Structure

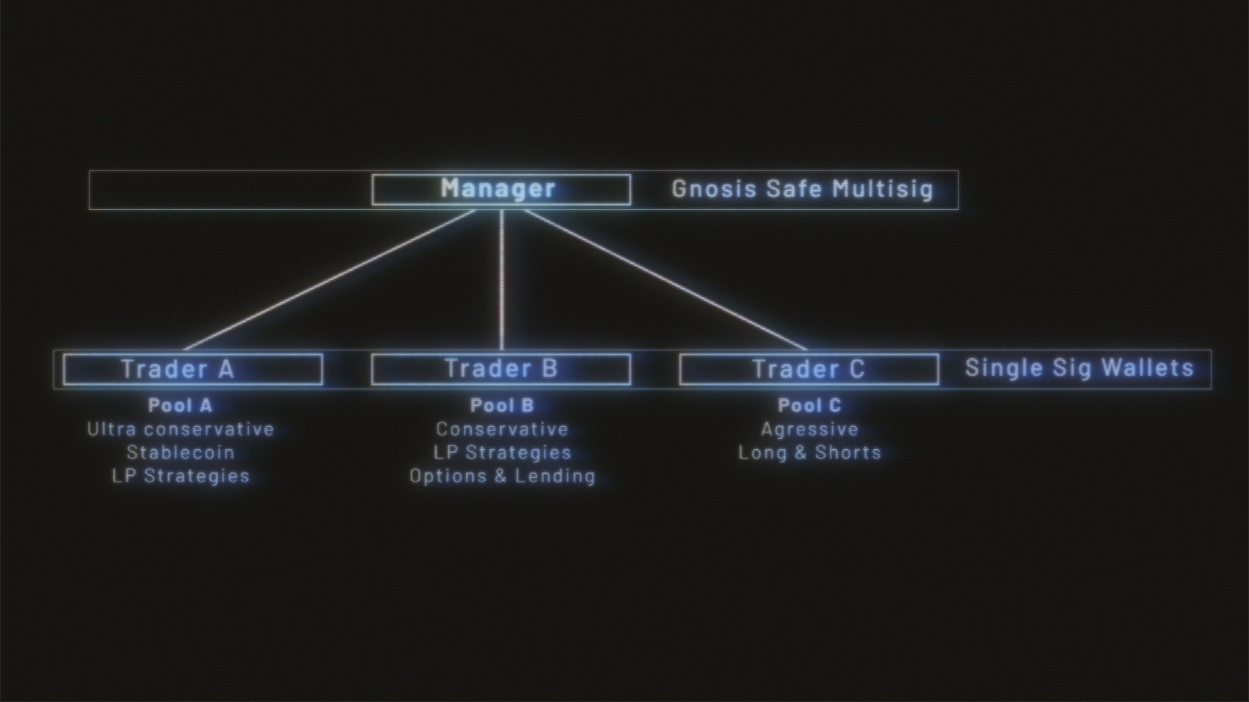

As an example, below is a potential basic Treasury asset allocation structure where the DAO allocates a subset portfolio to one of three traders.

Delegation of portfolio is set by the DAO as manager, executed through the existing Multisig approval process. Once a portion of the Treasury is allocated to the manager, together with controls around whitelisted assets, the Trader is free to execute positions within those agreed limitations.

At no point can the trader withdraw Treasury assets or transfer to external wallets.

Treasury Management Strategies

dHEDGE is integrated with many leading DeFi protocols to enable a range of management strategies.

Managed Liquidity

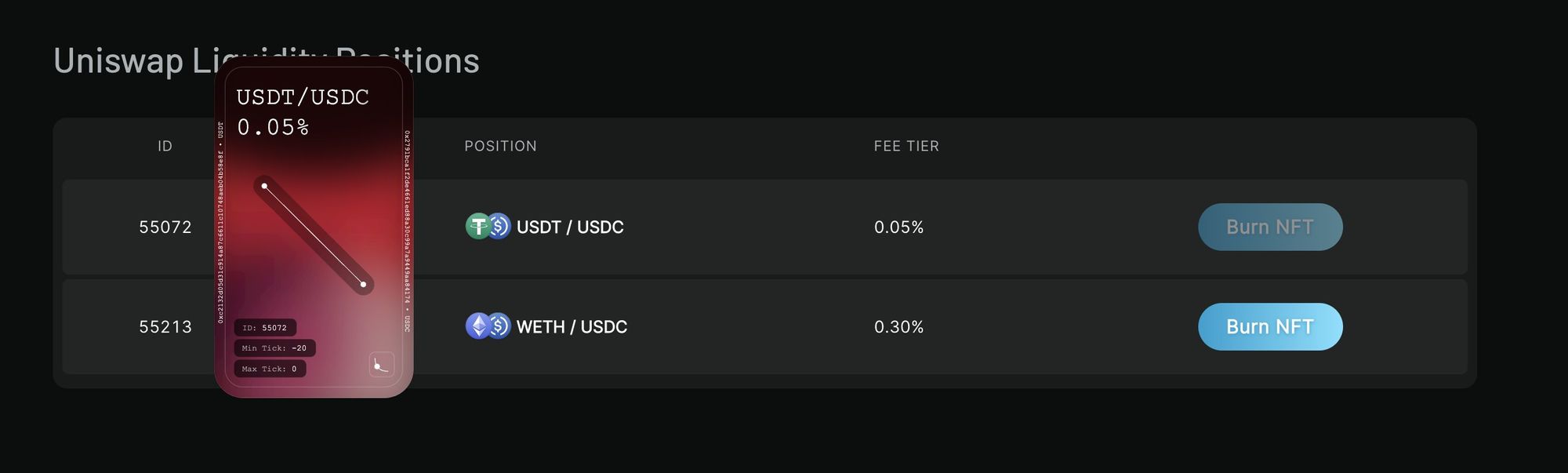

dHEDGE is integrated with Balancer, Sushi and as of the Aurora release, Uniswap v3.

This enables managers the flexibility to include managed liquidity positions across a range of protocols, whether it be stablecoin pools or native protocol token liquidity pools.

Optimising yield on Uni v3 requires active management to ensure concentrated liquidity is deployed effectively. Attempting to manage a tight price band with a multisig wallet can be onerous and prohibitive due to coordination of signatories and transaction urgency.DAOs can benefit via using dHEDGE to allocate specific UniV3 liquidity pools to specific managers, together with the authority and permissions to manage the pool from a single wallet.

All investors in dHEDGE pools receive an ERC-20 dHEDGE pool token representing their share of the pool. These tokens can be utilised in protocol staking strategies, where DAOs could offer staking rewards for investors staking these pool tokens - helping to incentivise managed liquidity TVL.

As an example, a portion of DHT Liquidity is managed in this pool https://app.dhedge.org/pool/0xede2a8526336bbe1b61a2da6ae467ed008567bea, which as of pre-Aurora release is following a Sushi LP strategy in a DHT-WETH pool.

dHEDGE Bot SDK

Managed liquidity on UniV3 can also be automated using the native dHEDGE Bot SDK, a suite of tools designed to help managers implement custom automated strategies on dHEDGE.

A tutorial on using the SDK can be found here:

https://medium.com/dhedge-org/dhedge-bot-sdk-e825e6f469c8

Stablecoin Yield

dHEDGE powers the dUSD token, a tokenised stablecoin yield strategy which farms the highest yielding stablecoin pools on Polygon. Rewards and fees earned from providing stablecoin liquidity are harvested and recapitalised into the strategy on an automated basis.

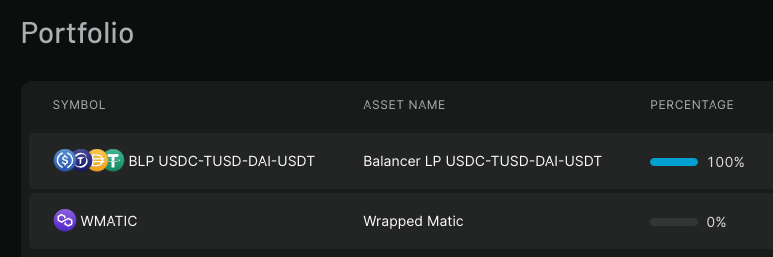

As of time at publishing, assets currently in the dUSD pool are committed to the USDC-TUSD-DAI-USDT stablecoin pool on Balancer:

Lending

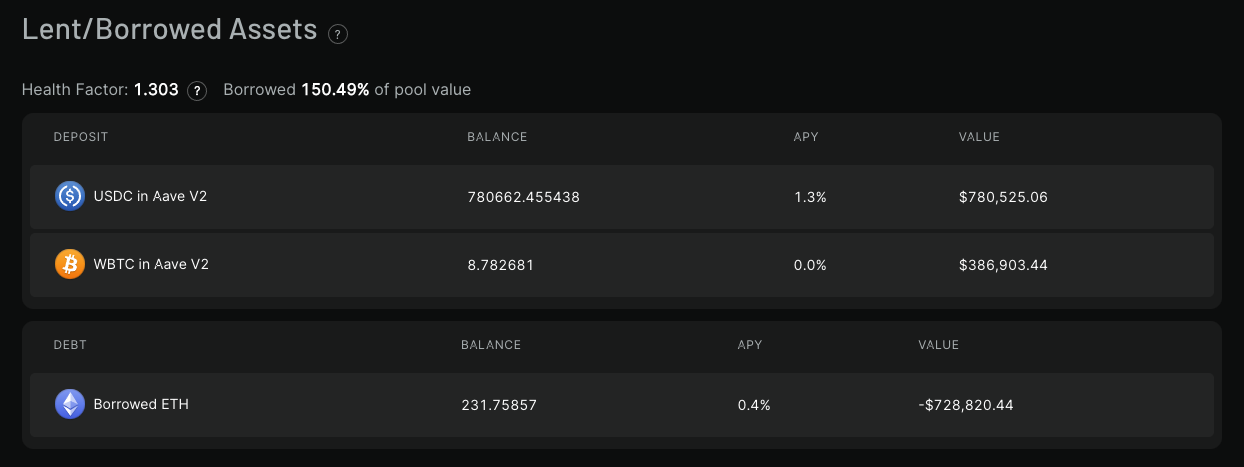

dHEDGE is integrated with Aave, enabling managers to take debt positions and lend against whitelisted assets.

The pool below demonstrates a lending strategy with a short ETH position, including reporting on interest rates and debt Health Factor.

Structured Products

Integrating with dHEDGE incubated protocol Toros, managers are able to access leveraged tokens on ETH and BTC.

Multichain Exposure

dHEDGE operates across Ethereum Mainnet, Polygon and Optimism. Pools on each chain are restricted to whitelisted assets and integrations per chain. An overview of the current integration landscape is below:

| Ethereum Mainnet | Polygon | Optimism | |

|---|---|---|---|

| dHEDGE Version | V1 | V2 | V2 |

| Kwenta | ✅ (Synthetix) | ✅ | |

| 1inch | ✅ | ||

| Uniswap | ✅ | ✅ | |

| Sushi | ✅ | ||

| Quickswap | ✅ | ||

| Aave | ✅ | ||

| Balancer | ✅ | ||

| Toros | ✅ |

New integrations have been rolling out every new release.

The roadmap for launching dHEDGE V2 on Ethereum Mainnet can be prioritised based on DAO Treasury need.

More About dHEDGE

dHEDGE is a decentralized asset management protocol connecting the world’s best investment managers with investors on the blockchain in a permission less, non-custodial, trustless fashion. dHEDGE aims to democratize the investing experience leveraging Blockchain technology.

Supported by some of the biggest names in crypto, including Framework Ventures, Three Arrows Capital, BlockTower Capital, DACM, Maple Leaf Capital, Cluster Capital, Lemniscap, LD Capital, IOSG Ventures, NGC Ventures, Bitscale Capital, Divergence Ventures, Genblock Capital, Trusted Volumes, Altonomy, Continue Capital, The LAO, bitfwd (比特未来) and Loi Luu, Co-Founder and CEO of Kyber Network,

Join the dHEDGE community on Discord, Twitter, Telegram English language, Telegram Chinese language and on WeChat.