New Integration: Arrakis Finance

dHEDGE is excited to announce a new integration with Arrakis Finance

dHEDGE is excited to announce a new integration with Arrakis Finance.

Arrakis Finance, a spin-off protocol from Gelato Network, is a managed liquidity service that automates Uniswap v3 positions. Arrakis was previously known as G-Uni, and is currently live on Polygon.

Integrating Arrakis with dHEDGE provides managers with the convenience of automated managed liquidity services, in the case where a manager doesn’t want to manually control the liquidity ranges on Uniswap directly.

A core benefit for dHEDGE managers is direct access to Polygon’s new $15m Uniswap v3 incentive program, where “The first phase of the incentive program will allocate $3 million from the recently unveiled tokenized LP deposits from Arrakis Finance”

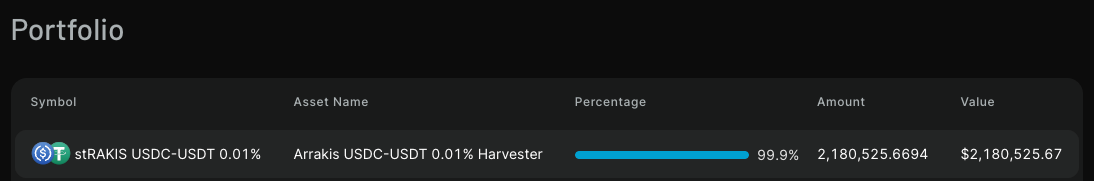

An additional benefit for dHEDGE and Toros Finance investors is the ability for the Stablecoin Yield dynamic vault to benefit from the additional MATIC incentives. At time of publishing, Stablecoin Yield is currently LPing into the Arrakis incentivised USDC-USDT pool, boosted by MATIC rewards.

Arrakis core contributor kassandra.eth adds:

“Arrakis Vaults bring more composability to Uniswap V3 Liquidity so that it may be utilized as a money lego across the DeFi landscape. We’re excited to partner with dHedge to offer more ways to gain exposure to Arrakis’ ecosystem of LP Positions and liquidity mining incentives”

Incentivized Arrakis pools include WMATIC-USDC, WMATIC-WETH, USDC-WETH, WBTC-WETH, USDC-USDT, AAVE-MATIC and USDC-miMATIC.

More About dHEDGE

dHEDGE is a decentralized asset management protocol connecting the world’s best investment managers with investors on the blockchain in a permission less, non-custodial, trustless fashion. dHEDGE aims to democratize the investing experience leveraging Blockchain technology.

Supported by some of the biggest names in crypto, including Framework Ventures, Three Arrows Capital, BlockTower Capital, DACM, Maple Leaf Capital, Cluster Capital, Lemniscap, LD Capital, IOSG Ventures, NGC Ventures, Bitscale Capital, Divergence Ventures, Genblock Capital, Trusted Volumes, Altonomy, Continue Capital, The LAO, bitfwd (比特未来) and Loi Luu, Co-Founder and CEO of Kyber Network,

Join the dHEDGE community on Discord, Twitter, Telegram English language, Telegram Chinese language and on WeChat.