The dHEDGE Ecosystem. A 2025 Recap and What’s Ahead in 2026

2025 recap

2025 has been a year of growth for the dHEDGE ecosystem, driven without user incentives.

Let’s start with some numbers:

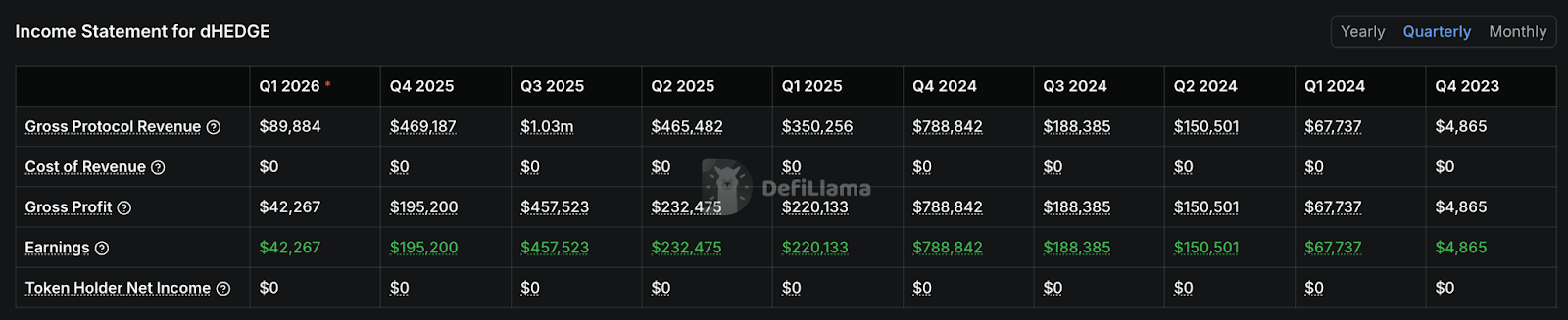

In 2025 the protocol generated ~$2M in income.

Around half of those earnings came from fees, primarily driven by Toros Finance.

The remainder came from market making and yield farming activities.

The DAO didn’t spend anything on incentives to generate those earnings, unlike many protocols that rely on short term rewards to boost metrics.

Thus far, ~30% of DHT circulating supply has been bought back through both market buybacks and OTC with token holders.

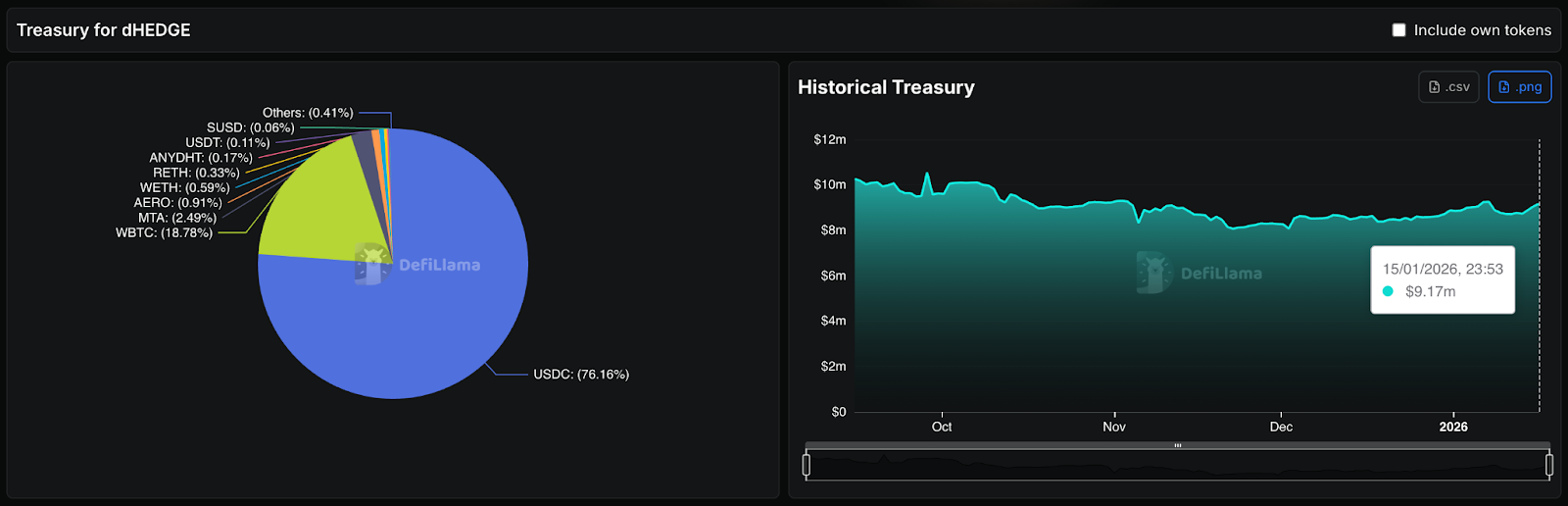

dHEDGE has a healthy liquid treasury with a runway of 4+ years, even without accounting for future income.

Sophisticated vault managers have been able to outperform the market while managing risk.

Toros Finance has expanded into a wider range of assets and launched Protected Leveraged Tokens which have provided protection during market volatility.

mStable relaunched with a new Pendled vault which continues to grow, now averaging ~15% APY.

Flat Money is in the process of relaunching with Everlasting options designed to support the Toros Protected Leveraged Tokens.

DHT buybacks

DHT has been trading below NAV in 2025 and the protocol has been buying back the token.

This has resulted in the DAO now holding over 60% of the total DHT supply, up from 40% in prior years.

The buybacks will continue into 2026 and the impact will accelerate as the circulating supply shrinks.

Every few months, there is some discussion around projects buying back their tokens versus reinvesting into product and growth.

There is a big difference between a token trading above its liquid treasury value versus below it (above or below NAV).

There are many instances where the token is overvalued and projects would be better off reinvesting funds into the protocol instead of making buybacks.

dHEDGE is in the opposite position.

If DHT is trading well below NAV we owe it to our token holders to give them a fair value on their DHT.

If dHEDGE is in a position to buy back its undervalued tokens and still continue to operate, then the buybacks will continue.

Hyperliquid

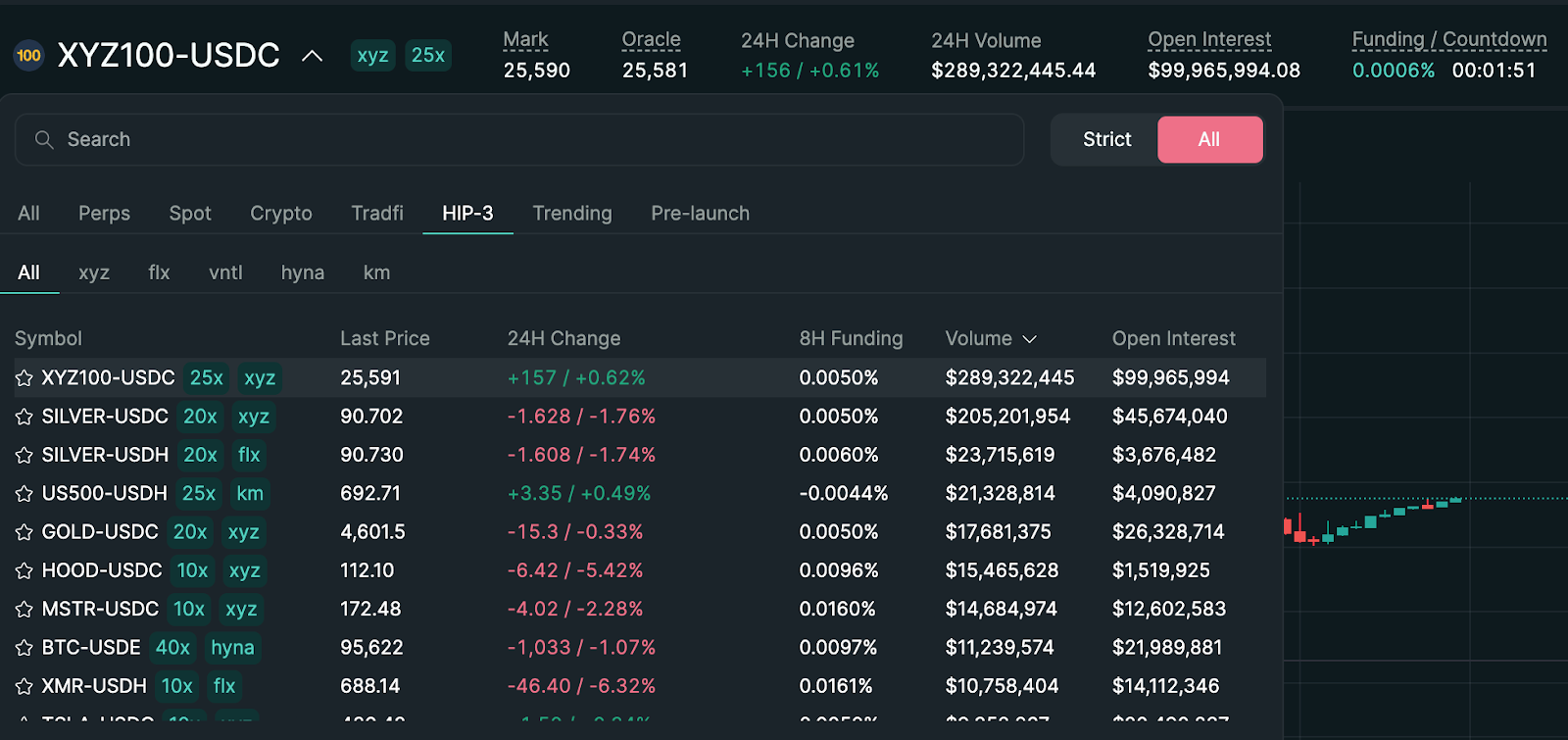

The dHEDGE team has been working to integrate the Hyperliquid HyperEVM to open up the ability for managers to trade on Hyperliquid. With USDC bridging now possible, keep an eye out on this going live soon.

Hyperliquid trading on the HyperEVM is an clear value add for dHEDGE managers. It will open up a tail of assets on a single chain for trading and leveraging. This will be one of the biggest value unlocks for both dHEDGE and Toros. It will include commodities like gold and silver, as well as stocks.

RWAs: Stocks and commodities

With AI-driven growth of tech stocks, dHEDGE will be offering highly liquid tokenized stocks for managers to trade including NVDA, TSLA, GOOGL.

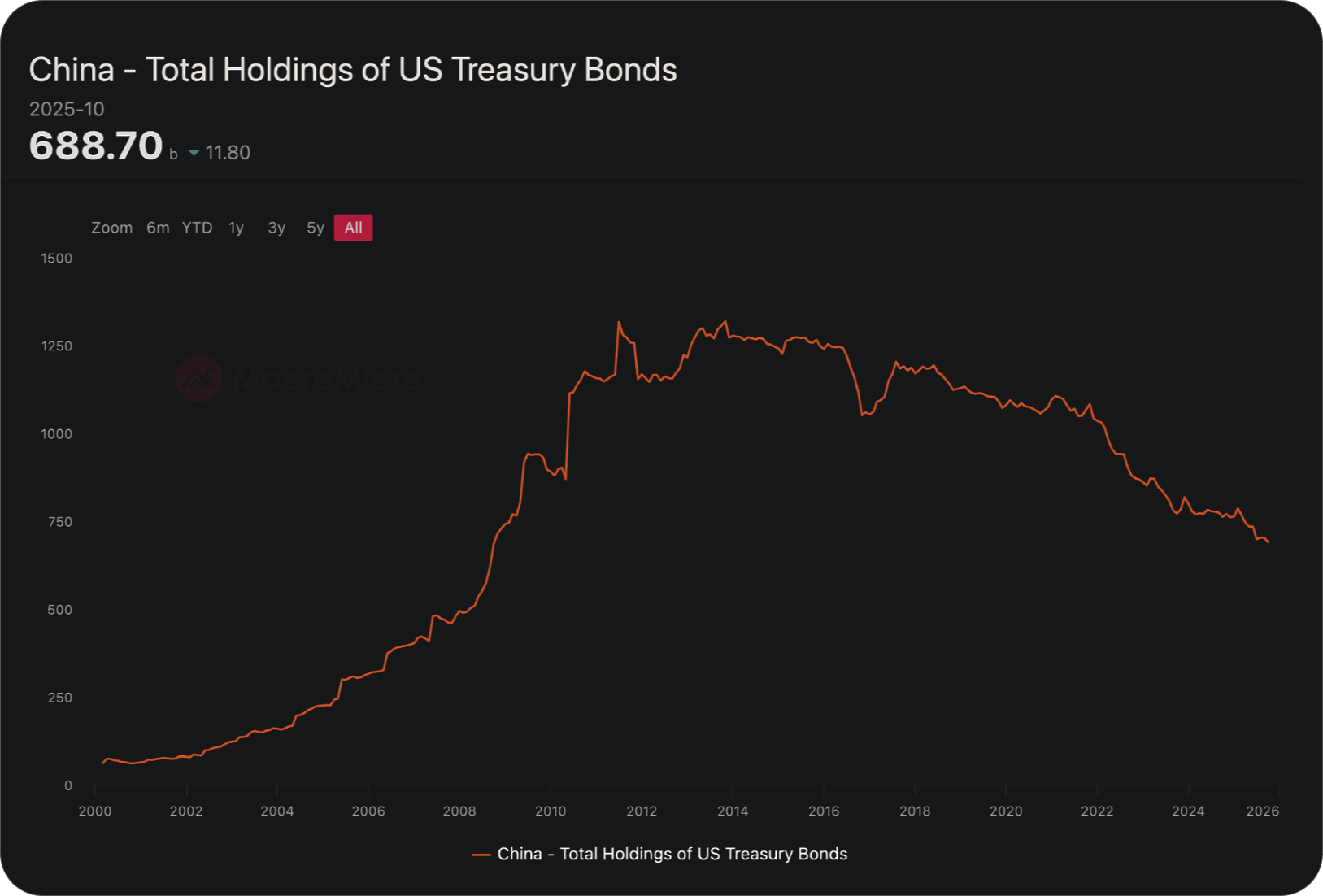

Gold and silver have soared in late 2025 as some central banks diversified their reserves away from the US dollar and into gold. We expect this trend to continue into 2026 with traders increasingly looking for commodities exposure.

In general you can expect dHEDGE to grow its RWA offerings this year and stay ahead of the curve.

Toros

Toros Finance expanded its range of Leveraged Tokens including SUI, XRP and gold.

Toros also launched Protected Leveraged Tokens which have offered superior downside protection with leveraged upside.

These protected token offerings will expand in 2026.

Toros will also offer stock and commodity leveraged tokens with its own bespoke lending market.

This new lending market will enable leveraged stocks, commodities and ETFs.

All tokenized and interoperable across Ethereum.

More details will be shared as this goes live.

mStable

mStable was relaunched in late 2025 with a new Pendle-Aave-Ethena leveraged sUSDe yield vault. This is the most advanced onchain yield strategy developed by the team to date and has been averaging 15% APY.

With Ethereum Mainnet expected to continue scaling at a 3X+ throughput annually, mStable is doubling down on Ethereum as the future of onchain yield.

This will continue to be mStable’s flagship product as the most transparent and secure high yield vault.

Flat Money

Flat Money has sunset its original flatcoins and will be focusing on bootstrapping a new type of perpetual options market, Everlasting Options.

This will make it simple to earn yield from selling options on BTC, ETH and other future supported assets via options that never expire.

Arbitrum is the home of derivatives and is the perfect chain for this new primitive.

A rebrand is planned to reflect this new direction.

Onwards

In 2025 the dHEDGE ecosystem continued to expand while generating income.

In 2026, expect a broader range of products including stocks and commodities for managers.

This will enable a new wave of Toros leveraged tokens.

Tokenization of assets like stocks and gold is becoming more common. We are positioning the dHEDGE ecosystem to support new trading strategies around these assets.

A call to managers

As the ecosystem expands into new assets and markets, access to experienced managers becomes increasingly important.

If you know any great directional traders of major crypto assets, feel free to share the application below.

We are looking to help bootstrap new talented managers onto the platform, particularly those with a track record of reliably outperforming the market.